Car loan delinquencies have been rising. Key factors include termination of loan relief programs post pandemic, rising inflation, higher interest rates, and higher used and new car prices, which have resulted in extended payments on car loans. According to Cox Automotive.

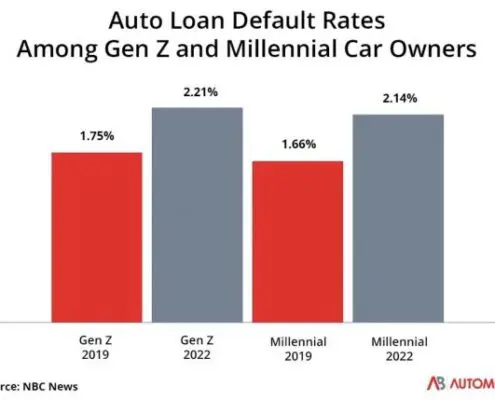

According to TransUnion data, 4.35% of car owners ages 18 to 40 were at least 60 days late on their auto loans in early 2022. In 2019, before the pandemic began, Gen Z had a past-due rate of 1.75%. Today, past-due rates have reached as high as 2.21% among Gen Z car owners. Similarly, millennials now show increased past-due rates of 2.14% compared with 1.66% before the pandemic.

The percentage of subprime auto borrowers who are at least 60 days past due on payments rose to 5.67% in December from a seven-year low of 2.58% in April 2021. That compares with the peak of 5.04% in January 2009 during the financial crisis according to Fitch Ratings

Soaring used car prices have forced buyers to take out more loans for their vehicles amid the coronavirus pandemic. In an era of government stimulus checks, a tight labor market and a soaring stock market, monthly loan payments may seem like a no-brainer. But things have changed for many as inflation eats into consumer budgets and the job market cools.

More Americans are now delinquent on their auto loans in the United States than during the financial crisis.

Higher interest rates make it harder for Americans who borrow to buy cars to make monthly payments. The average new-car loan rate was 8.02% in December, up from 5.15% in the same period in 2021, according to Cox Automotive. Interest rates for subprime borrowers can be much higher, with some even paying over 25% on their car loans.

Nationwide auto auction companies will repossess 11% more cars in 2022 than the previous year, but still down 26% from 2019.